Introduction

Canada is one of the top destinations for students worldwide, offering excellent universities, diverse cultures, and a high standard of living. But while education is a priority, one thing students often overlook is health insurance. Medical expenses in Canada can be costly without proper coverage, making health insurance a necessity—not a choice.

Whether you’re an international student arriving in Toronto, Vancouver, or Montreal, or a Canadian student studying away from your home province, understanding the best health insurance for students in Canada is critical. In this guide, we’ll explore everything you need to know: how health insurance works, provincial vs private coverage, university health plans, costs, best providers, and tips to choose the right policy.

What Is Student Health Insurance in Canada?

Student health insurance is a policy that covers medical costs while studying. It ensures students can access:

- Doctor visits

- Hospital care

- Diagnostic tests (X-rays, blood tests, MRIs, etc.)

- Emergency services

- Prescription medications

Without coverage, even a short hospital stay could cost thousands of dollars.

👉 Quick fact: A single ER visit in Canada can cost between $600 – $1000 CAD without insurance.

Why Do Students Need Health Insurance in Canada?

- Healthcare Costs Are High – Canada’s healthcare system is not universally free. Public healthcare is tax-funded, but eligibility varies by province.

- International Students Are Not Always Covered – Some provinces include international students in public healthcare, while others require private insurance.

- Mandatory for Study Permits – Many Canadian universities require proof of insurance before enrollment.

- Covers Unexpected Emergencies – Accidents, sudden illnesses, or chronic conditions can arise anytime.

📌 For more, see official Government of Canada health insurance requirements

How Health Insurance Works in Canada for Students

Health insurance for students falls into three main categories:

1. Provincial Health Insurance (Public Coverage)

Each province in Canada manages its healthcare system. Some provinces extend public health insurance to international students, while others do not.

- British Columbia (MSP): International students with study permits of 6+ months are eligible after a 3-month waiting period.

- Alberta (AHCIP): Free coverage for students with valid study permits.

- Saskatchewan Health Card: International students are eligible.

- Manitoba: Ended free coverage for international students in 2018; private insurance is required.

- Ontario: Does not cover international students; universities provide UHIP.

2. University/College Health Insurance Plans

Most Canadian universities automatically enroll students in a group insurance plan. Premiums are added to tuition fees.

- Ontario: Students are covered under the University Health Insurance Plan (UHIP).

- Quebec: Many universities provide group insurance through Desjardins or Blue Cross.

- Other provinces: Institutions often partner with providers like Guard.me, Morcare, or StudyInsured.

Benefits:

- Affordable because of group rates

- Covers doctor visits, hospital stays, and emergencies

- Add-ons for dental and vision available

3. Private Health Insurance

For students not eligible for public coverage, private insurance is the best choice.

Top private providers:

- Guard.me – Specializes in student health insurance.

- Morcare – Works with Canadian colleges and universities.

- StudyInsured – Offers flexible student plans.

- Allianz Care Canada – Global coverage with Canadian networks.

Best Health Insurance Providers for Students in Canada (2025)

Here are the most popular and reliable options:

1. Guard.me International Insurance

- Coverage: Doctor visits, hospital care, prescriptions, mental health, emergency evacuation.

- Cost: Around $60–$80 per month.

- Good for: International students in provinces without public coverage.

🔗 Visit Guard.me

2. Morcare

- Coverage: Medical emergencies, prescriptions, dental, vision (add-ons).

- Cost: $720–$900 per year.

- Good for: Students in colleges/universities partnered with Morcare.

🔗 Visit Morcare

3. StudyInsured

- Coverage: Medical emergencies, hospitalization, follow-up care.

- Cost: $600–$900 annually.

- Good for: Students needing flexible options.

🔗 Visit StudyInsured

4. Allianz Care Canada

- Coverage: International coverage, emergency services, mental health.

- Cost: $100+ per month (premium option).

- Good for: Students traveling frequently or needing worldwide protection.

How Much Does Health Insurance Cost for Students in Canada?

Provincial Plans (if eligible): ~$75 per month (BC MSP).

University Plans (UHIP, group plans): $600–$900 annually.

Private Plans: $60–$120 per month depending on coverage.

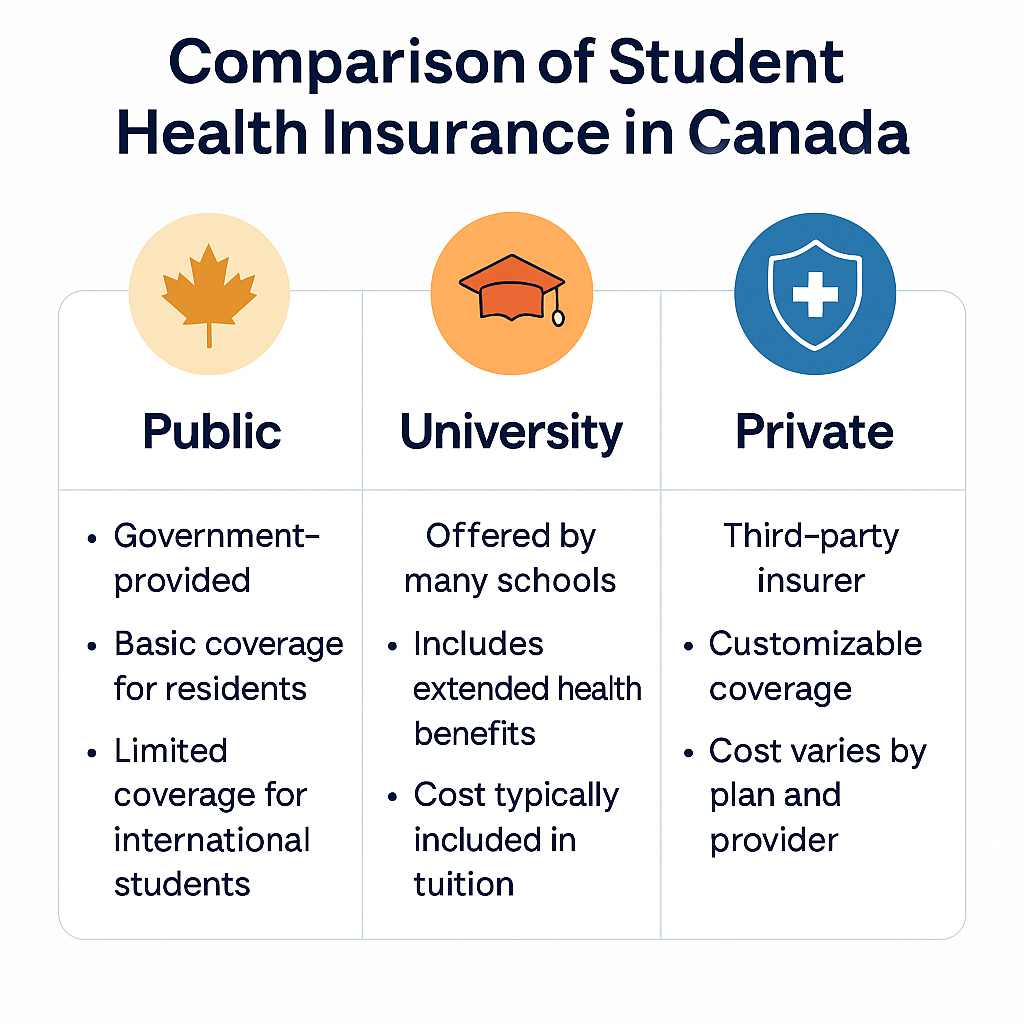

Comparison: Public vs University vs Private Insurance

| Category | Public Insurance | University Plans | Private Insurance |

| Eligibility | Only in certain provinces | All enrolled students | Anyone with a study permit |

| Cost | $0–$900/yr | $600–$900/yr | $700–$1500/yr |

| Coverage | Basic healthcare only | Medical + emergencies | Comprehensive (may include dental/vision) |

| Best for | Students in Alberta, BC, Saskatchewan | International students in Ontario, Quebec | Students needing flexible/add-on coverage |

Tips to Choose the Best Health Insurance Plan

- Choose a provider with 24/7 customer support.

- Check if your province provides coverage.

- Confirm if your university automatically enrolls you in a plan.

- Consider add-ons like dental, vision, or mental health.

- Compare costs and deductibles.

FAQs: Health Insurance for Students in Canada

Q1. Can international students get free healthcare in Canada?

Only in provinces like Alberta, BC, and Saskatchewan. Others require private coverage.

Q2. What is UHIP in Ontario?

The University Health Insurance Plan (UHIP) covers international students in Ontario.

Q3. Does health insurance cover dental and vision?

Not usually; add-ons are available.

Q4. How do I apply for provincial healthcare?

Submit your study permit, enrollment proof, and address to the provincial health authority.

Q5. Can I keep my home country insurance?

It may cover emergencies, but Canadian providers are recommended.

Conclusion

Choosing the best health insurance for students in Canada depends on your province, university, and health needs. Some provinces offer public coverage, but in most cases, international students must rely on university group plans or private insurance. Providers like Guard.me, Morcare, and StudyInsured are widely trusted across Canada.

Having the right plan ensures peace of mind, protects you from high medical costs, and lets you focus on your education without stress.

Disclaimer

This article is for informational purposes only and should not be taken as medical or financial advice. Students should always confirm details with their university, insurance provider, or provincial health authority before purchasing a plan.

External links: Link to Government of Canada – Health Insurance, Guard.me, and Morcare.