Introduction

Teaching is more than a career—it’s a lifelong commitment to shaping the future. But while teachers dedicate themselves to their students, it’s equally important to protect their own families’ futures. That’s where life insurance comes in.

The good news? Teachers in the UK have access to several affordable life insurance options, many of which are tailored to their profession. From term policies to workplace benefits, this guide explains what teachers need to know, which policies to consider, how much they cost, and where to find the best deals in 2025.

What is Life Insurance and Why Teachers Need It

Life insurance provides a lump-sum payment (the “death benefit”) to your chosen beneficiaries if you pass away during the policy term. For teachers, this means ensuring:

- Family financial security – helping cover mortgage, bills, or childcare.

- Debt protection – ensuring loans or credit cards aren’t left unpaid.

- Education continuity – covering children’s tuition or university costs.

- Peace of mind – knowing loved ones won’t struggle financially.

📌 Teachers often have long-term career stability but modest income, so finding affordable coverage with the right benefits is key.

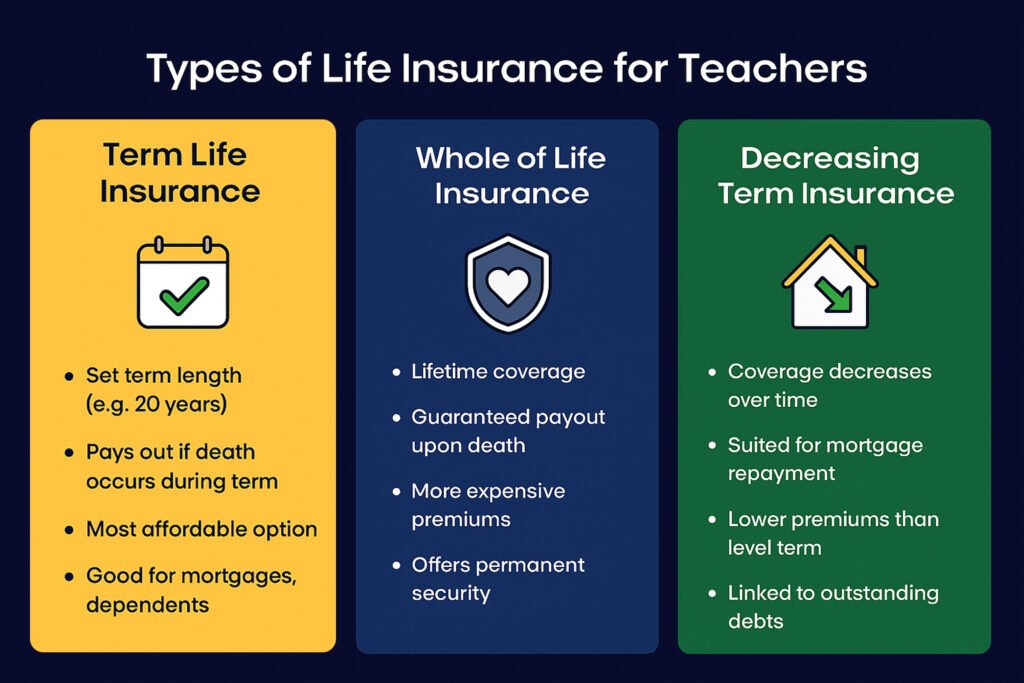

Types of Life Insurance Available in the UK

1. Term Life Insurance

- Covers you for a set period (10, 20, 30 years).

- Pays out if you die during the policy term.

- Affordable option, especially for younger teachers.

- Popular for covering mortgages and dependent children.

2. Whole of Life Insurance

- Covers you for life (as long as premiums are paid).

- Guaranteed payout at death.

- More expensive but offers permanent security.

3. Decreasing Term Insurance

- Coverage amount reduces over time (usually tied to a mortgage).

- Premiums are lower compared to level-term cover.

- Good for teachers paying off home loans.

4. Group Life Insurance for Teachers (via Workplace)

- Some schools, academies, or unions offer group life cover.

- Often free or subsidised by employers.

- Typically provides a payout of 2–4x annual salary.

5. Critical Illness Add-On

- Can be added to policies.

- Pays out if diagnosed with certain serious illnesses.

- Helps teachers who may not be able to work after a diagnosis.

Affordable Life Insurance Options for Teachers in the UK

Here are the best ways teachers can secure affordable coverage:

1. Teacher-Specific Life Insurance Policies

Some providers and unions have tailored products for educators:

- Teachers’ Assurance (via unions) – competitive rates for teaching staff.

- National Education Union (NEU) – membership may provide access to group life cover.

2. Compare Term Life Insurance Quotes

Using UK comparison sites like:

- MoneySuperMarket

- Compare the Market

- GoCompare

Teachers can quickly find affordable life insurance quotes in the UK.

3. Employer-Sponsored Benefits

Many schools, especially in the public sector, include death in service benefits.

- Usually 2–3x annual salary.

- Can complement a personal life insurance policy.

4. Low-Cost Providers for Teachers

Some of the most competitive UK insurers in 2025 include:

- Legal & General

- Aviva

- VitalityLife

- AIG Life UK

How Much Does Life Insurance Cost for Teachers?

Premiums depend on:

- Age – younger = lower premiums.

- Health history – non-smokers and healthy teachers save more.

- Coverage amount – higher payout = higher cost.

- Policy type – term is cheaper than whole of life.

Average monthly premiums in the UK (2025):

- 30-year-old teacher, healthy, £250,000 term cover → £12–£20/month

- 40-year-old teacher, £250,000 term cover → £20–£35/month

- Whole of Life cover (same teacher, 40) → £60–£90/month

Tip: Teachers under 35 years old can lock in very low rates for the duration of their term.

Step-by-Step: How to Buy Affordable Life Insurance as a Teacher

- Assess your needs – mortgage, dependents, debts, future costs.

- Check workplace benefits – confirm if you already have “death in service” coverage.

- Decide coverage type – term vs whole, decreasing term if tied to a mortgage.

- Compare quotes online – use comparison sites to find best rates.

- Disclose health honestly – medical exams may be needed for higher coverage.

- Add riders if necessary – critical illness, income protection.

- Review annually – adjust as salary, debts, and family situation change.

Common Mistakes Teachers Make with Life Insurance

- Relying only on workplace cover – may not be enough to support family long-term.

- Choosing the cheapest policy blindly – lowest price isn’t always best value.

- Ignoring inflation – payouts may lose real value over decades.

- Not reviewing coverage – life changes (marriage, kids, house) require updates.

- Forgetting about tax planning – some payouts may be subject to inheritance tax if not placed in trust.

Tips for Saving on Life Insurance

- Buy life insurance while young and healthy – lock in cheaper premiums.

- Choose term over whole life if affordability is a priority.

- Opt for decreasing term cover if your main goal is paying off a mortgage.

- Use teacher discounts or group coverage when available.

- Avoid smoking and maintain good health to reduce premiums.

FAQs: Affordable Life Insurance for Teachers in the UK

Q1. Do teachers in the UK get free life insurance?

Some schools and academies provide death in service benefits, but this is not universal and may not be enough.

Q2. What’s the cheapest life insurance option for teachers?

Term life insurance is usually the most affordable.

Q3. Can I get life insurance through my teacher’s union?

Yes, some unions like NEU offer access to group life insurance plans.

Q4. Does life insurance cover critical illness?

Not automatically—you’ll need to add a critical illness rider.

Q5. How much life insurance do I need as a teacher?

Experts recommend 10–12x annual salary to protect your family.

Q6. Can I get life insurance without a medical exam?

Yes, but premiums may be higher. Most basic policies under £250,000 may not require a medical.

Q7. What is death in service benefit?

It’s a benefit provided by some employers, usually 2–4x annual salary, paid if you die while employed.

Q8. Is life insurance taxable in the UK?

Generally not, but payouts can be subject to inheritance tax if not in a trust.

Q9. Can older teachers still get affordable life insurance?

Yes, but costs rise with age. Consider shorter terms or smaller cover amounts.

Q10. What happens if I change schools?

If you rely only on workplace cover, you may lose it. Always maintain a personal policy too.

External Resources

Conclusion

Life insurance might not be the first thing on a teacher’s mind, but it’s one of the most important financial tools for protecting your loved ones. By comparing affordable life insurance options for teachers in the UK, checking workplace benefits, and using online comparison tools, you can secure peace of mind without breaking the bank.

Whether you choose term, whole, or group coverage, the key is to start early, review regularly, and tailor your policy to your unique needs as an educator.

Disclaimer

This article is for informational purposes only. Clamifio does not sell insurance and this content does not constitute financial advice. Always consult a licensed insurance advisor or provider in the UK before purchasing a policy.