Introduction

A life insurance policy is more than a financial product—it’s a promise of security for loved ones after the policyholder passes away. But for beneficiaries, the relief of having a policy in place is often followed by uncertainty: “How do I actually file a life insurance claim?”

The life insurance claim process explained here is designed for an international audience. Whether you live in the U.S., U.K., Canada, Australia, or abroad, the fundamentals remain the same: notifying the insurer, providing documents, completing forms, and waiting for verification and payout.

In this guide, we’ll walk you through:

- FAQs for quick clarity.

- 7 essential steps for filing a life insurance claim.

- What documents you’ll need.

- How long claims typically take.

- Common denial reasons (and how to fix them).

What Is a Life Insurance Claim?

A life insurance claim is a formal request made by a beneficiary to the insurer, asking for payment of the death benefit after the policyholder dies. Unlike health or car insurance, life insurance isn’t automatic—beneficiaries must initiate the process.

If everything checks out (policy was active, beneficiary is valid, cause of death isn’t excluded), insurers pay out the death benefit, which is usually tax-free in most countries.

Step 1: Notify the Insurer Promptly

The first step is to inform the insurance company as soon as possible. Most insurers provide multiple ways to notify:

- Phone hotlines

- Online claim portals

- Email support

- Through an agent or broker

Why this matters: Quick notification reduces delays and prevents complications like unclaimed benefits.

Pro Tip: Write down the claim reference number. You’ll need it for follow-ups.

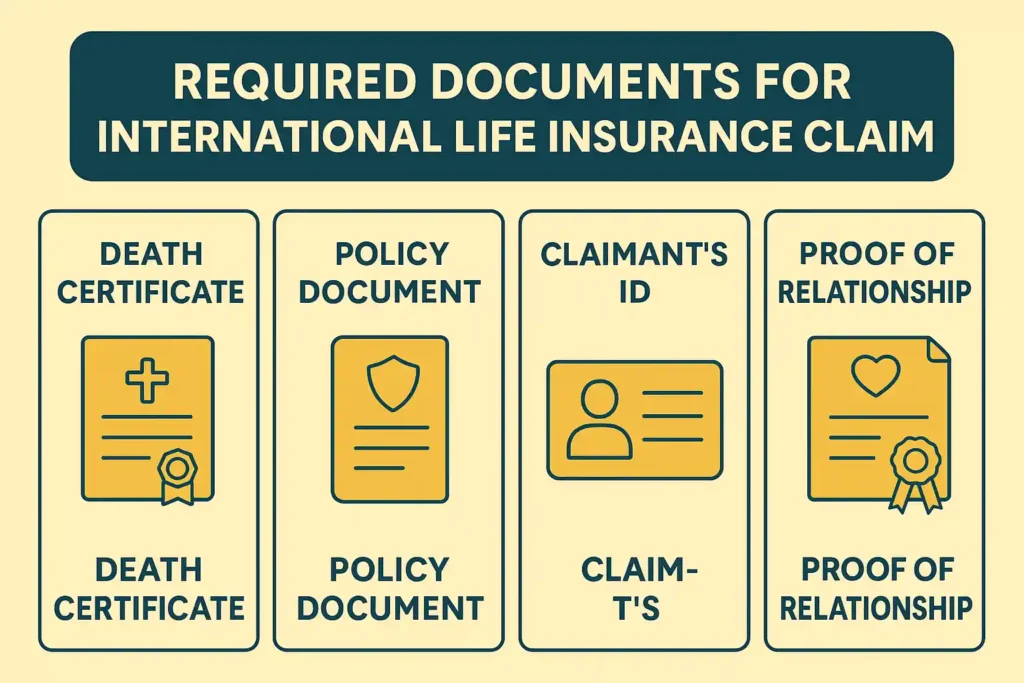

Step 2: Gather Required Documents

The life insurance claim process explained always emphasizes documentation. Without complete paperwork, insurers cannot release payouts. Here’s what you typically need:

- Certified death certificate (official copy).

- Original policy document (or policy number if digital).

- Government-issued ID of the claimant.

- Proof of relationship (if required—marriage certificate, birth certificate).

Special Case: Death Abroad

If the policyholder dies outside their home country, you may also need:

- Foreign death certificate translated into English.

- Consular confirmation letter from the embassy.

- Police or investigation reports (especially during the contestability period).

Step 3: Complete the Claim Form

Every insurer provides a claim form—either online or paper. This form asks for:

- Beneficiary’s details

- Policy number

- Policyholder’s details

- Cause and date of death

✅ Ensure accuracy. Small mistakes (e.g., spelling errors, incomplete answers) can cause unnecessary delays.

Step 4: Verification and Review

Once the insurer receives your claim, they begin verification. This includes:

- Checking if the policy was active.

- Confirming beneficiary identity.

- Reviewing cause of death against exclusions.

The Contestability Period

Most policies have a 2-year contestability clause. If the policyholder dies within 2 years of purchase, the insurer may investigate more deeply for fraud or misrepresentation.

Step 5: Claim Processing Timeline

“How long does a life insurance claim take?”

- Standard cases: 30–60 days after documents are submitted.

- Group life policies: Often within 36 days.

- Complex cases: May extend to 90–120 days (foreign deaths, contestability cases).

Tip: Stay proactive—follow up every 2 weeks with your claim reference number.

Step 6: Payout Options

When approved, insurers pay the death benefit in one of two ways:

- Lump-Sum Payment – full payout at once (most common).

- Installments or Annuity – spread over years, useful for long-term planning.

💡 Most payouts are tax-free, but always check local tax laws or consult a financial advisor.

Step 7: Handling Denials or Delays

Not every claim is approved immediately. Common denial reasons include:

- Policy lapse (premiums weren’t paid).

- Excluded cause of death (e.g., suicide in first 2 years).

- Incorrect or incomplete documents.

- Suspicion of fraud.

What to do if denied:

- Request a written explanation.

- Submit missing documents.

- File an appeal with the insurer.

- Seek legal assistance if necessary.

Real-World Example: International Claim Scenario

Imagine a U.K. teacher working in Dubai who passes away. The beneficiary (living in London) must:

- Obtain a Dubai-issued death certificate.

- Have it translated and notarized.

- Submit it to the U.K.-based insurer with embassy confirmation.

This may extend timelines, but with proper documentation, the claim can still be honored.

Tips for a Smooth Life Insurance Claim Process

- Keep a claim-ready folder with ID, policy, and beneficiary details.

- File the claim as soon as possible—delays can complicate verification.

- Double-check documents before submission.

- Stay in touch with the insurer’s claims department.

- Use an insurance lawyer for disputed or denied claims.

FAQs

Q1. How soon should I file a life insurance claim?

As soon as possible. Early filing ensures faster payout.

Q2. What if the policyholder died abroad?

You’ll need translated and verified documents, plus consular confirmation.

Q3. How long does a payout take?

Usually 30–60 days, but longer if under contestability review.

Q4. Are life insurance benefits taxable?

In most cases, no. But consult a tax professional in your country.

Q5. Can insurers deny claims?

Yes, for reasons like fraud, policy lapse, or exclusions.

Q6. What if I lost the policy document?

You can still claim using the policy number or insurer records.

Q7. What happens if there are multiple beneficiaries?

The payout is split according to policy instructions.

Q8. Can I appeal a denied claim?

Yes. Submit additional documents or hire a lawyer if needed.

Q9. Do insurers pay partial claims?

Not usually—either approved in full or denied, unless riders apply.

Q10. Can I track my claim online?

Many insurers offer portals or claim trackers—check with your provider.

Conclusion

The life insurance claim process explained here may seem complicated, but by breaking it down into 7 clear steps, beneficiaries can navigate it with confidence. From notification to payout, preparation and documentation are your best allies.

Disclaimer

This blog is for informational purposes only. Clamifio does not provide insurance products. Always consult your insurer or a licensed advisor for specific advice.